Why Data-Driven Steering is Becoming Essential

Data is no longer a byproduct – it’s becoming the primary driver of how industries reinvent themselves. In the used vehicle business, however, much of this potential remains untapped. Automotive OEMs sit on a vast amount of customer, contract, vehicle, and usage data, but trade-in and remarketing processes still often follow rigid rules: expected vehicle return dates are tied to contractual end dates, capacity planning typically relies on experience rather than reliable forecasts, and the remarketing process often starts only once the trade-in process has been fully completed.

The result: higher costs and lost revenue caused by process inefficiencies – from congested compounds and idle vehicles losing value to suboptimal remarketing outcomes.

Data-driven steering provides a clear way forward. It can not only improve planning accuracy but also unlock entirely new use cases:

- Better resource planning: manage compound and workshop capacity based on reliable return forecasts.

- Vehicle remarketing before return: position vehicles on the market before they are physically returned to minimize idle time.

- Usage of vehicle and workshop data: identify wear and tear or damage early to ensure optimal return condition.

- Restrict equipment combinations in new vehicle sales: only allow configurations with known strong resale potential.

- Automated channel allocation: automatically assign vehicles to the remarketing channel with the highest expected resale value, either in the domestic market or internationally.

- Dynamic vehicle pricing: dynamically recalculate offer prices by taking a holistic end-to-end view, thus ensuring maximum overall profits.

These examples show that the data assets of OEMs are not just an operational byproduct. They can become a true enabler for innovative business models, unlock efficiency gains, and optimize revenues.

From Fixed Contract End Dates to Flexible Forecasts

Return planning at many OEMs is still tied to the initially agreed contract end date and often supplemented by expert judgement, for instance through dedicated planning committees. In practice, return dates frequently shift: Contracts in the fleet segment often allow flexible return windows, and vehicles may come back later due to contract extensions or delayed new vehicle deliveries. Others are returned early once mileage limits are reached or when customers switch to new models.

This mismatch between planned and actual returns creates noticeable inefficiencies:

- Congested compounds: sudden peaks in certain months drive up vehicle idle times, processing costs, and loss of value.

- Increased distribution movements: vehicles may need to be relocated multiple times between compounds and processing parties such as agents, appraisers, or workshops.

- Inefficient resource utilization: workshops and logistics swing between overload and underutilization.

- Unreliable sales steering: remarketing teams face fluctuating supply, making pricing and channel decisions less effective.

Detailed knowledge of return characteristics is key to nearly all other optimization levers in the used vehicle business. We therefore analyzed real return patterns to better understand how contractual, vehicle-related, customer, and seasonal factors influence actual return dates – and which of them really matter.

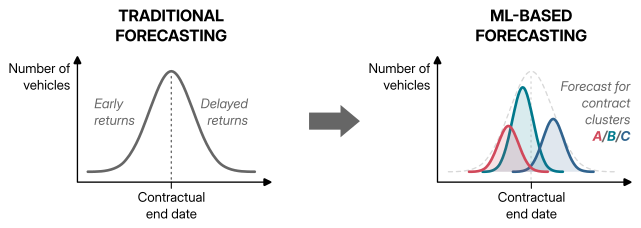

Simplified comparison between traditional and ML-based return forecasting. While traditional forecasting (left) treats all contracts as one homogeneous group, the ML-based approach (right) differentiates between contract types and predicts individual return patterns. Each curve (A, B, C) represents a distinct contract cluster with varying contract durations, annual mileage limits, or vehicle types, resulting in more accurate and granular forecasts.

Up to 30% More Accurate Planning with Machine Learning

As an initial proof of value, we developed a deliberately simple machine learning (ML) model that considers three key factors influencing leasing vehicle return dates: initial contract duration, annual mileage limit, and vehicle type. Rather than predicting the absolute return date, it estimates the expected deviation from the contractual end date.

To evaluate the ML model’s performance, we applied a planning approach commonly used in the industry: return planning in monthly bins strictly based on the predicted return date. By comparing the average deviation between predicted and actual returns over multiple months, we assessed the improvement achieved with the ML-based approach compared to the conventional method.

The effect is significant: deviations between planned and actual returns can be reduced by as much as 30 percent. This means fewer surprises in compound utilization, more efficient use of appraisal, workshop, and logistics capacity, and more predictable vehicle supply for remarketing teams. And while today’s return forecast is often only updated once or twice a year, ML models can be updated periodically as new data becomes available.

Prototypes as the Bridge to Implementation

However, demonstrating more precise return planning in an analytical setting is only a first step. Real value only emerges once these improvements are proven in daily operations. Instead of spending too much time and money refining models without business validation, it is far more effective to prove their impact early with a lightweight and cost-efficient approach.

A prototype serves exactly this purpose. It is designed to be as self-sufficient as possible: encapsulated, easy to operate, and without the need for deep integration with the existing IT landscape. At the same time, it can be applied directly within established processes such as return planning and compound capacity management routines.

This makes the added value of data-driven steering visible: operational teams benefit from more precise forecasts, and management can see measurable results without having to commit to large-scale implementation projects upfront. In this way, the prototype lays the groundwork for scaling the approach and anchoring it in the OEM’s IT landscape.

Unlocking Business Value with Senacor

The true potential lies in the many data-driven use cases still waiting to be explored. When data is systematically integrated into operational and decision-making processes, OEMs can unlock new efficiencies, strengthen profitability, and enable entirely new business models.

This is where Senacor excels: we combine deep automotive domain expertise with a proven track record in building sustainable IT solutions.

Our work spans the full value chain:

- We identify and realize data-driven use cases, from early proof-of-concept to fully integrated solutions.

- We design ML- and AI-driven approaches that are seamlessly embedded into operational processes.

- We build comprehensive data architectures and platforms, ensuring integration, harmonization, and governance across the end-to-end value chain.

- We bridge business and IT by translating domain needs into technological solutions.

All of this is driven by one guiding principle – every Senacor project creates actual business impact. By following a pragmatic, iterative approach, we ensure that ideas are not just discussed, but tested, proven, and implemented. Step by step, hypotheses evolve into scalable solutions that deliver lasting results.