Introduction

The Digital Euro Rulebook Development Group (RDG) published their latest update v0.9 on the Digital Euro Scheme Rulebook in June 2025. Senacor took a deeper look at the current state of the scheme rulebook and covers some important topics and highlights in this blogpost. As banking and payments experts, we would like to contribute to the market discussion to foster a successful development and introduction of the digital euro and invite our clients and industry partners to comment to our views and contributions. (Find us on LinkedIn)

The Current State of Digital Euro Development

Entering the Final Phase of Preparation

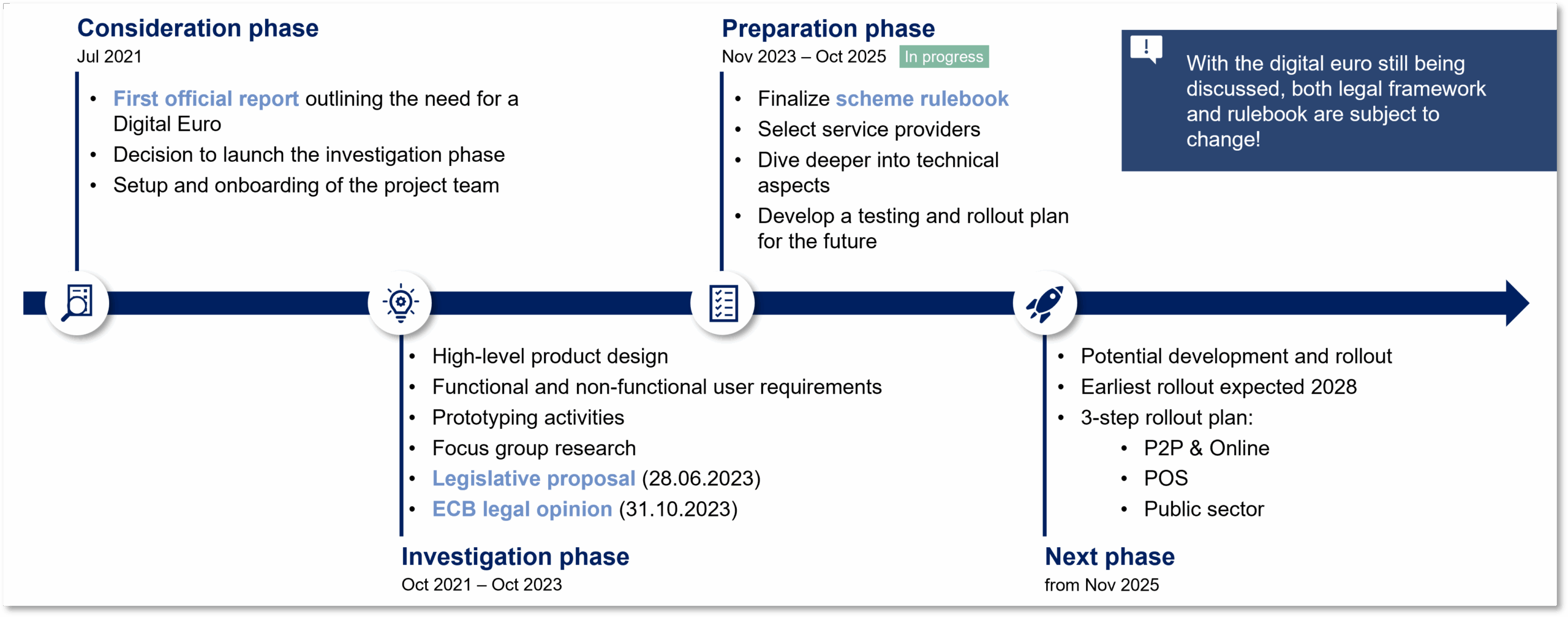

The digital euro project has officially entered what the European Central Bank (ECB) describes as the final phase of its two-year preparation period, which began in November 2023 and is scheduled to conclude in October 2025. This preparation phase represents a fundamental shift from the previous investigation phase (October 2021 to October 2023) toward concrete implementation planning and stakeholder engagement. The current phase focuses on finalizing the digital euro scheme rulebook, selecting technical infrastructure providers, and conducting extensive testing and experimentation to ensure the digital currency meets both regulatory requirements and user needs.

This marks the transition from theoretical design to practical implementation. The ECB’s Governing Council will make the crucial decision on whether to proceed with the actual issuance of the digital euro following the completion of this preparation phase in October 2025, with the final determination expected in 2026 once the European Union’s legislative framework has been adopted.

The Digital Euro Rulebook Development

Group’s Landmark Publication

A significant development in the digital euro’s progression has been the publication of the current state of work by the Digital Euro Rulebook Development Group (RDG), representing the most comprehensive documentation of the project’s technical and operational specifications to date. The RDG, comprising over 50 experts from more than 30 organizations representing the European retail payments market, has been instrumental in developing the scheme rulebook that will govern digital euro operations across the eurozone.

The latest version of the rulebook (v0.9) represents a significant milestone in the project’s development. This preliminary draft provides important details about the digital euro’s proposed functionality, user experience requirements, technical specifications, and operational procedures. Still it is non-binding and subject to ongoing refinements based on legislative developments and stakeholder feedback. Thereby improvements are still possible and expected.

Key Validations and Technical Specifications

Product Design Validation and eIDAS Integration

The current rulebook version validates multiple critical assumptions about the overall product design, particularly regarding the close integration with the European digital identity system introduced through the eIDAS (Electronic Identification, Authentication and Trust Services) regulation. This integration represents a strategic decision to leverage existing European digital infrastructure, ensuring that the digital euro becomes part of a broader ecosystem of trusted digital services across the European Union. While ensuring a highest level of security and common KYC standards throughout the industry, it requires user to enrol with the EU Digital Identity Wallet to consume digital euro services.

Enhanced Functionality and Operational Mechanisms

The rulebook provides detailed specifications for several key functionalities that required extensive development and stakeholder input. Among the most significant are the switching mechanisms that allow users to seamlessly transfer their digital euro services between payment service providers (PSPs) while maintaining their Digital Euro Account Number (DEAN) and transaction history. This functionality addresses concerns about user lock-in and promotes competition among service providers by ensuring portability of digital euro services.

The dispute handling mechanisms have been extensively developed, establishing a comprehensive framework for managing transaction disputes, fraud prevention, and consumer protection. The system includes detailed procedures for various dispute scenarios, from unauthorized transactions to merchant disputes, with clear timelines and resolution processes designed to protect both consumers and businesses

Identified Limitations and Usability Concerns

Offline Device Restrictions

One of the most significant limitations identified in the current design is the restriction limiting individual users to only one offline digital euro device. This constraint, while understandable from security and anti-money laundering perspectives, presents substantial usability challenges for consumers who increasingly rely on multiple devices for daily transactions. The limitation could significantly impact user adoption, particularly among demographics that regularly use multiple payment devices or prefer redundancy in their payment options.

Research conducted by De Nederlandsche Bank suggests that users view offline functionality as critical for the digital euro’s resilience and backup capabilities, particularly during network outages or technical disruptions. The single-device limitation may conflict with this user requirement and the digital euro’s stated objective of delivering cash-like functionality in digital form.

Alias System Limitations

The current rulebook specifies significant restrictions on the alias system, which allows users to conduct transactions using easily memorable identifiers instead of complex account numbers (such as an 18-digit alphanumerical DEAN). Under the current specifications, aliases are limited to phone numbers only, with email addresses explicitly excluded from the rulebook v0.9. Furthermore, each user can maintain only one phone number alias linked to their Digital Euro Account Number, creating a one-to-one relationship that limits flexibility.

Implementation and Cost Concerns

Recent studies commissioned by major European banking associations reveal substantial implementation costs that could impact the digital euro’s rollout and adoption. Banks participating in the digital euro system are estimated to face initial costs exceeding €2 billion collectively, with individual institutions averaging €110 million in implementation expenses. When extrapolated across the entire eurozone, total implementation costs could reach €18 billion [1].

These costs are primarily driven by technical adaptations, including updates to mobile banking applications, integration of digital euro payment cards, and upgrades to ATM, branch, and point-of-sale infrastructures. Approximately 75% of the total costs are attributed to technical modifications, with the remainder allocated to operational changes, staff training, and compliance requirements. The study excludes ongoing operational costs, offline functionality implementation costs, and multiple account management expenses, suggesting that the total cost burden may be significantly higher than current estimates.

Market Engagement and Stakeholder Feedback

Intensive Stakeholder Consultation Process

The ECB has significantly intensified its stakeholder engagement activities throughout 2025, conducting extensive consultations with market participants, merchants, and consumers through various channels – in which Senacor actively participated. The Euro Retail Payments Board (ERPB) technical sessions have served as a primary forum for gathering structured feedback from industry representatives, with dedicated sessions focusing on specific aspects of the digital euro design, including holding limits, ecosystem integration, and business model considerations.

Through the recently launched innovation platform, approximately 70 market participants (including Senacor and SAP Fioneer) have conducted technical testing of digital euro features, including conditional payments and various integration scenarios. This experimentation has provided valuable insights into the practical challenges and opportunities associated with digital euro implementation, informing ongoing design decisions and technical specifications. The ECB has also engaged directly with vulnerable consumer groups and small merchants through focus groups and interviews, ensuring that the digital euro design addresses the needs of traditionally underserved populations.

Business Model and Value Proposition Challenges

Stakeholder feedback has revealed significant concerns about the digital euro’s business model and value proposition for market participants. Payment service providers have expressed uncertainty about revenue generation opportunities, given the digital euro’s mandate for free basic services to end users. The requirement for PSPs to provide digital euro services while absorbing implementation and operational costs without clear revenue streams has raised questions about the sustainability of the business model.

Merchants have indicated mixed reactions to mandatory digital euro acceptance requirements, with concerns about additional infrastructure costs and integration complexity. While some merchants appreciate the potential for reduced payment processing fees, others worry about the operational burden of supporting another payment method alongside existing systems. The feedback suggests that successful digital euro adoption will require careful calibration of the economic incentives for all ecosystem participants.

Future Outlook and Market Engagement Needs

The Path to October 2025 Decision

The digital euro project faces several critical milestones before the ECB’s Governing Council makes its decision on proceeding to the next phase in October 2025. Key deliverables include completing vendor selection and testing for the digital euro platform, publishing a refined draft rulebook for broader stakeholder review, and conducting additional user research and experimentation to validate privacy, security, and usability at scale.

The ECB has emphasized that the final decision on digital euro issuance will only be made once the European Union’s legislative framework has been adopted, ensuring full regulatory clarity before implementation begins. The ongoing legislative discussions in the European Parliament and Council of the European Union continue to influence technical specifications and design decisions, requiring flexibility in the rulebook development process.

Enhanced Market Engagement Requirements

The current state of digital euro development reveals a critical need for enhanced engagement with market participants to address identified limitations and optimize the system’s design for practical implementation. The ECB’s acknowledgment of this requirement represents a recognition that successful digital euro launch depends not only on technical functionality but also on market acceptance and adoption by all ecosystem participants.

Future engagement efforts should focus on addressing the specific usability concerns identified in the current rulebook. Market participants have indicated that these limitations could significantly impact user adoption and system usability, potentially undermining the digital euro’s objectives of providing a cash-like digital payment option. Collaborative efforts between the ECB and market stakeholders will be essential to identify practical solutions that balance security requirements with user convenience and functionality.

Conclusion and Call for Action

The digital euro project has reached a critical inflection point, with substantial progress made in developing the technical and regulatory framework necessary for Europe’s first central bank digital currency. The publication of the comprehensive rulebook and the intensive stakeholder engagement activities conducted throughout 2025 demonstrate the ECB’s commitment to creating a digital euro that serves the needs of all European citizens and businesses.

However, the identified limitations in offline device capabilities, alias system functionality, and business model sustainability indicate that significant work remains to optimize the digital euro design for successful market adoption. The substantial implementation costs revealed by recent banking industry studies also highlight the need for careful consideration of the economic implications and incentive structures supporting digital euro deployment.

The call for enhanced ECB engagement with market participants reflects a broader recognition that the digital euro’s success depends on collaborative development and implementation. Continued dialogue, experimentation, and refinement will be essential to ensure that the digital euro delivers on its promise of providing a secure, accessible, and efficient digital complement to physical cash while supporting European monetary sovereignty and financial inclusion objectives.

The digital euro represents more than a technological innovation; it embodies Europe’s strategic response to the challenges of digital transformation in the financial sector. Its successful development and implementation will require the combined efforts of policymakers, regulators, market participants, and citizens working together to create a digital currency system that serves the European public interest while fostering innovation and competition in the digital payments landscape.